Most retailers enjoy a relationship with a primary credit lender who is able to provide credit to a majority of customers applying. Unfortunately, there are still a large number of potential customers who are declined financing and end up leaving the store without being able to make a purchase. This impacts the retail bottom line and can lead to poor customer experiences and conversion rates.

Secondary lender credit requirements often offer a number of alternative, flexible programs and plans. Adding these providers typically help retailers eliminate up to 50% of their credit declines and maximize financing opportunities. More approvals generate more sales, leading to higher customer satisfaction and loyalty.

Versatile Credit partners with an unparalleled selection of 25+ primary, near-prime, and no credit needed providers to empower retailers to address consumers throughout the FICO spectrum. Our cascade application process securely transfers the application to secondary and tertiary providers after a decline, providing consumers with the ability to seamlessly discover a financing offer that works for them.

These comprehensive financing options are available on a variety of in-store devices, consumer mobile phones, and online. Retailers can customize the look and feel of the experience to ensure that their brand is being represented consistently on an array of devices and engagement points. Dedicated self-service kiosks and tablets are available, while existing devices such as in-store tablets and point of sales systems can be leveraged to provide customers with financing throughout the sales and consultation process. With turnkey and custom eCommerce integrations available retailers can integrate financing into their site quickly while ensuring remote shoppers are receiving the same financing opportunities provided in-store.

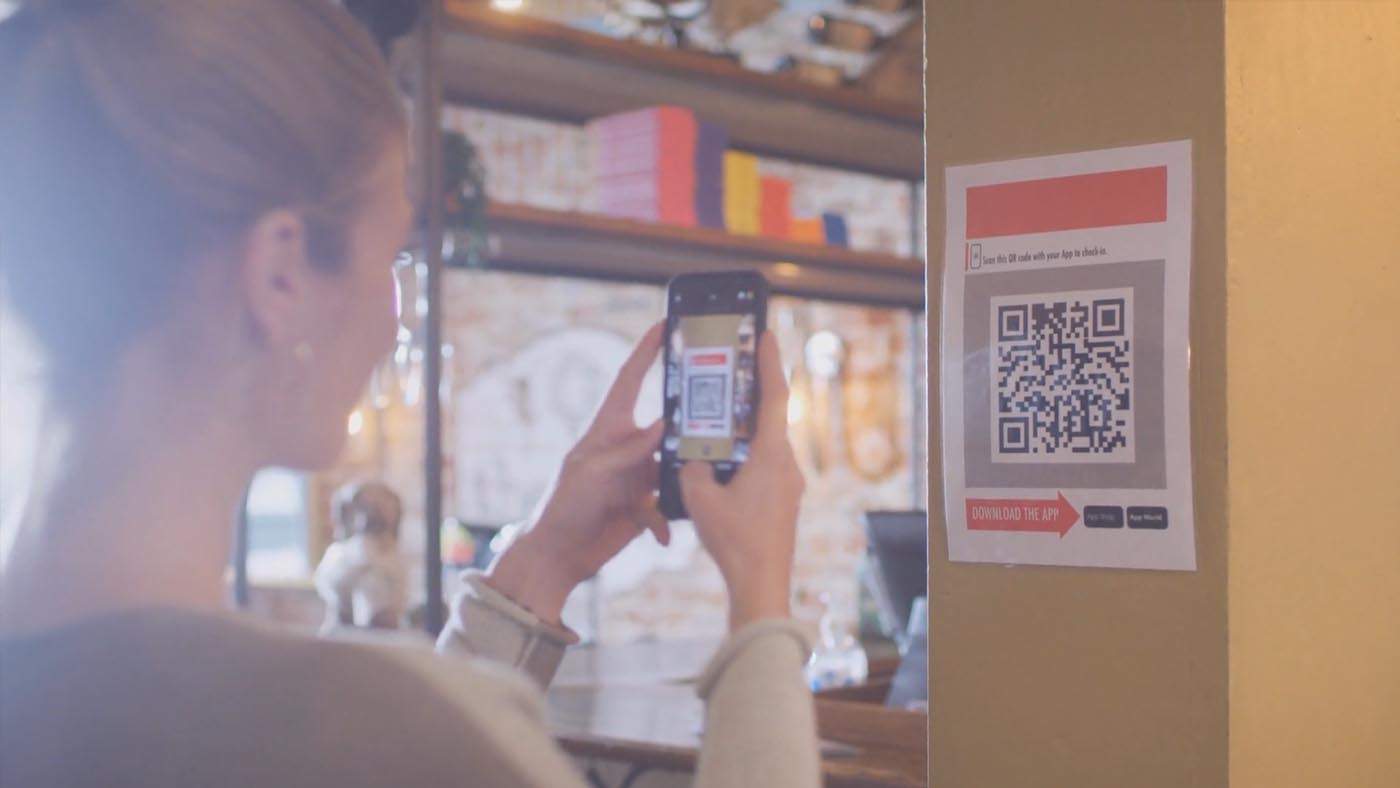

Snap Sign employs secure, dynamic QR Codes to enable retailers to offer contactless, self-service credit applications on consumer mobile devices while guaranteeing an in-store presence. Customers simply point their smartphone camera at the Snap Sign signage and they are instantly taken to the credit application on their phone. Snap Sign can be embedded into any existing digital platform, including kiosks, tablets, digital signage and point of sales computers — or on low cost, dedicated devices.

Adding secondary and no credit required options can significantly increase the percentage of customers being approved for financing throughout the FICO spectrum, enabling more customers to leave the store with the items and services they want. Versatile’s platform assists retailers in providing these financing options wherever and whenever a buying decision is made, online and in-store.

Contact us today if you’d like to learn how Versatile can help you build a comprehensive financing program in-store and online while driving higher application volume and approval rates.