The year of 2020, full of restrictions and limitations placed on retailers and consumers, saw a wave of innovation and growth in how and where merchants offered their services and products to shoppers. Many retailers pivoted to e-Commerce while sprinting to implement new technologies and tools to help offer their traditional customers with the same thoughtful shopping experience they have come to expect from modern brand, including services like expedited delivery, in-store pickup, and other tools meant to emulate the in-store experience, such as remote shopping assistance and augmented reality.

The last year has also changed how many shoppers research, purchase, and order their products, with e-Commerce shopping volumes growing nearly 10% since the beginning of 2020. However, as the world begins to open back up, 65% of consumers around the world have returned to brick and mortar according to a recent survey from Oracle. According to recent information from Zenreach, in-store visits to retail, restaurant, and entertainment locations have increased over 44% since the beginning of 2021. As restrictions around the world continue to be relaxed and lifted, retailers are challenged with the task of understanding their customers and what drives them to make their buying decisions, and how to provide them with the best tools and experiences, wherever their buying decisions are being made.

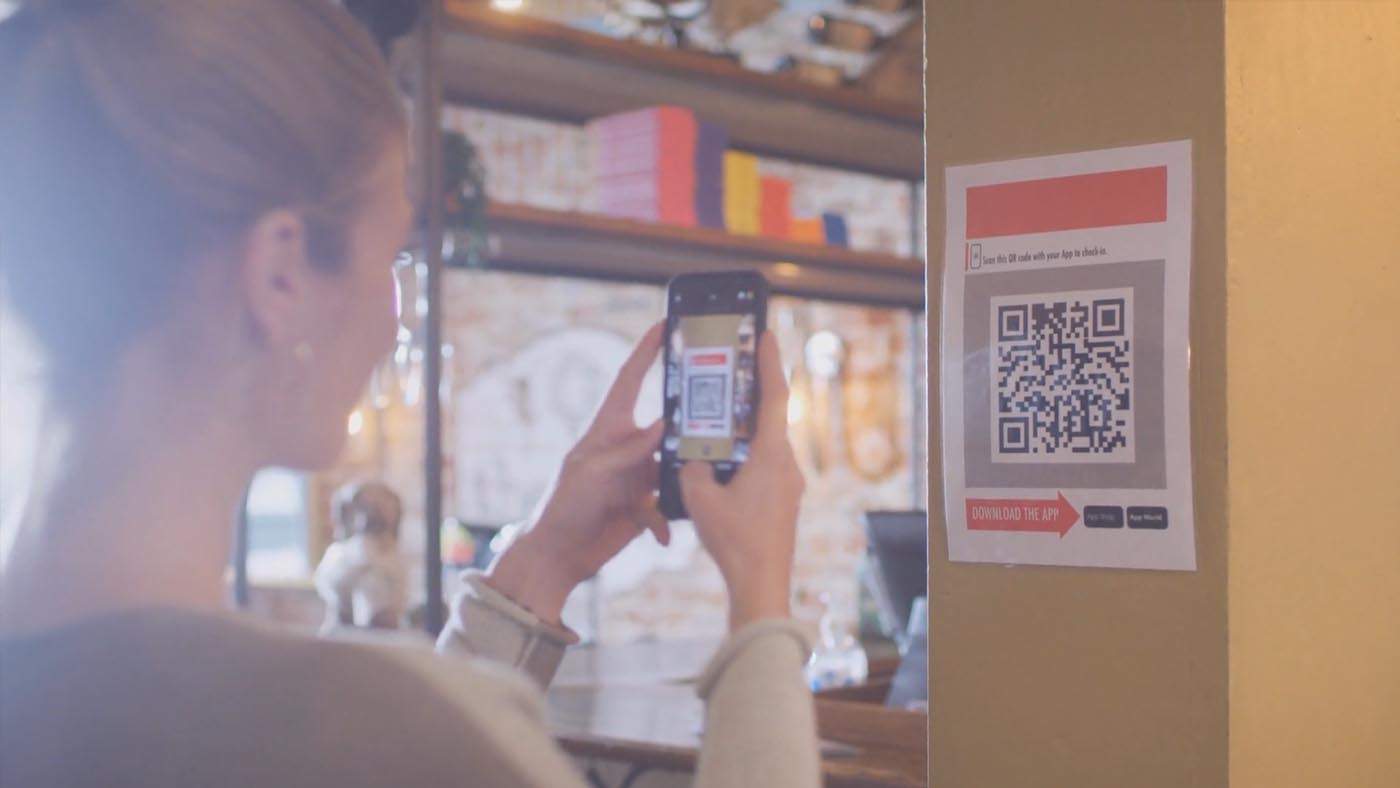

Recently, in an article for RetailDive, Christopher Sarne, Senior Director of Product Management Strategy at Oracle, expressed the importance of brands offering adaptable, personalized experiences for shoppers in-store and online. “This connectivity effectively brings both sides closer together, aligning the processes that prevent brands from achieving effective and efficient omnichannel synergy”. Christopher points out that, according to Oracle’s survey, 71% of customers favor speed of service and ease of check out when deciding whether to continue shopping with a retailer, stating that “this preference makes a compelling case for implementing mobile checkout and self-service tools at physical stores, creating a similarly streamlined online shopping experience.”

It will be important for retailers to have the tools to understand how their customers are interacting with their brand and vertical, and the tools necessary to provide those shoppers with the products and shopping experiences they are looking for in a post-pandemic world. As Christopher Sarne says in his article, “retailers must fully pivot to the customer, putting them at the core of business decisions and maximizing the customer journey.”

Versatile Credit can help your business understand how and where shoppers are utilizing financing, and provide you with the tools to drive engagement and financing approvals for all shoppers, across the FICO spectrum. Versatile as an array of in-store and e-Commerce technologies, including self-service kiosks, contactless, transition-to-mobile technologies, and easy-to-deploy e-Commerce integrations to help retailers provide shoppers with dynamic and comprehensive financing options in-store and online. Retailers can ensure they are maximizing the financing opportunities for their customers while leveraging Versatile’s powerful analytics platform, Versatile Insight, to gain understanding into the performance of their financing program and channels.

Want to learn more about how Versatile Credit can help your business offer comprehensive financing options to shoppers, regardless of where they make their buying decisions? Reach out today for a demo!