Many states throughout the country have issued “Stay at Home” orders in response to the COVID-19 outbreak, and as the vast majority of our fellow citizens comply, that has motivated forward thinking retailers to re-evaluate their in-store experiences and interactions between customers, employees, and their physical storefronts.

Once restrictions begin to be relaxed and the country begins to move beyond COVID-19, consumers may still rightfully feel cautious about how they interact with devices and employees when seeking credit or other services in-store. It will become vitally important for retailers to understand how their stores and in-store devices can be effectively cleaned and maintained to help ensure the safety of their employees and customers, and to begin to make processes and technologies available to consumers to help minimize viral transmission and contact. If fact, many retailers are investing time and resources during mandatory closures to make their business environment consumer friendly for post crisis shoppers.

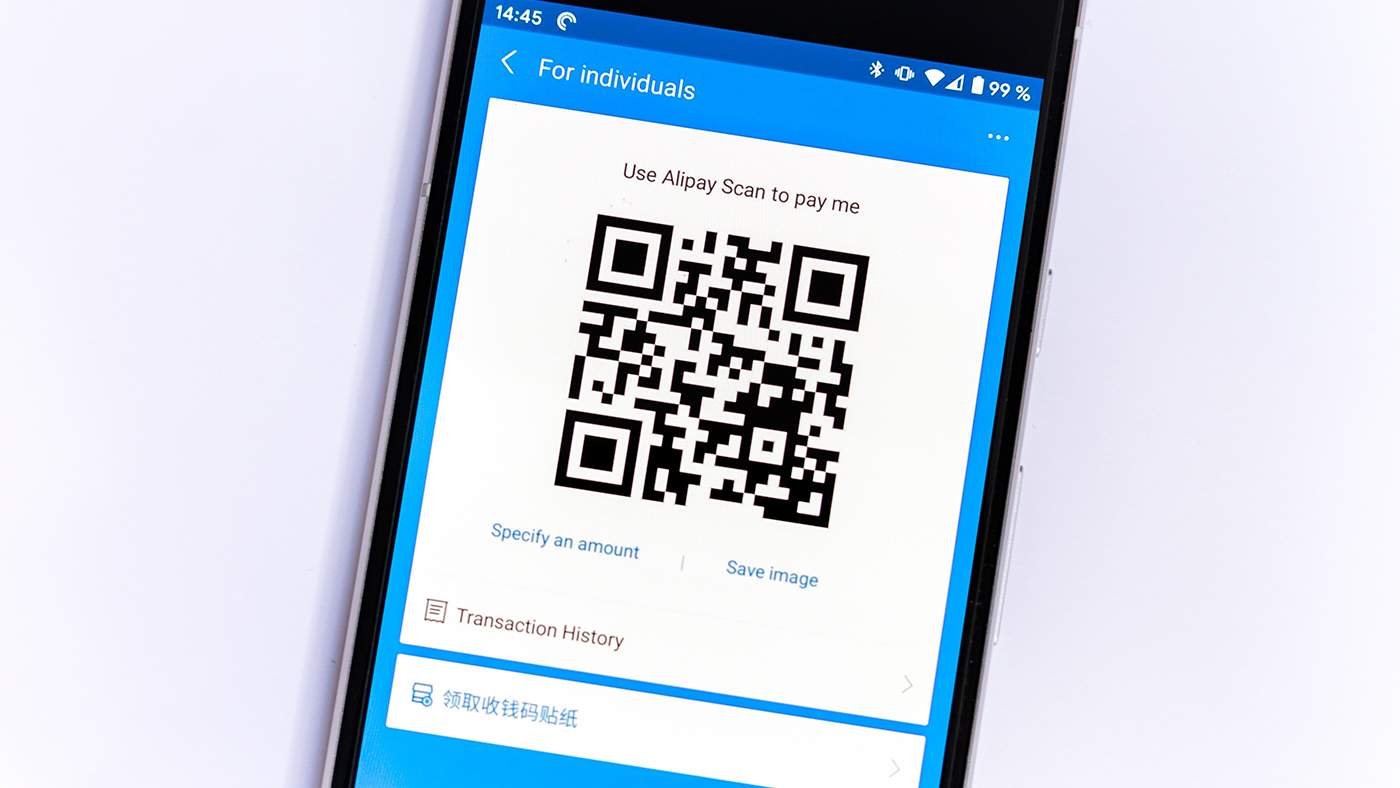

Beginning in 2007 credit card issuers began to release “contactless payment” features on their cards, enabling consumers to pay for their order at checkout by simply tapping their card on a payment terminal. Phone manufacturers, like Apple and Samsung, have released contactless payment features on phones which allow consumers to create a “digital wallet” and make payments in-store by simply tapping their mobile device. These solutions help to provide options and ease-of-use to consumers, with the unintended consequence of facilitating a decrease in the transmission of germs, viruses and bacteria.

Versatile Credit is equipped to assist retailers in evaluating the effect enhanced consumer (and employee) concerns about safeguarding personal health may have on their sales and in-store financing programs through a suite of contactless self-service options. Versatile is making this suite of options available to retail partners, which is designed to work within their existing sales processes, empowering them to provide customers with a frictionless transition of the application experience to a consumer’s mobile device.

“Snap Sign” is a patent-pending technology that blends the use of a personal device and a retailer’s digital signage with dynamic QR codes providing shoppers with a secure self-service financing option while validating that the applicant is in-store. Customers simply point their smartphone camera at the Snap Sign signage and they are automatically taken to a credit application on their phone.

Retailers can also utilize Versatile’s “Text to Apply” technology to enable their sales staff to securely deliver customers a single-use link to a credit application directly on their mobile device, allowing them to apply completely on their phone.

Retailers can also provide self-service financing throughout their store through traditional printed signage using our QR-code based Snap to Apply technology. Any of these solutions will help to promote a more comfortable shopping experience for consumers who have enhanced health safety concerns and illustrate the retailer’s concern for the safety of valued customers and employees.

These solutions serve to help decrease transmission of germs and bacteria while also providing customers the opportunity to choose how they interact with the financing program and find the experience that is right for them.

If you’re interested to learn more about how Versatile can help you achieve contactless self-service for your financing program while driving higher application volume, please contact us.