PYMNTs and American Express recently reported that “workers and customers have both become wary of exchanging cash and using physical cards to make purchases. Shoppers also want to get in and out of stores as quickly as possible to reduce the time they spend in close proximity to others, making speedy purchasing methods essential.”

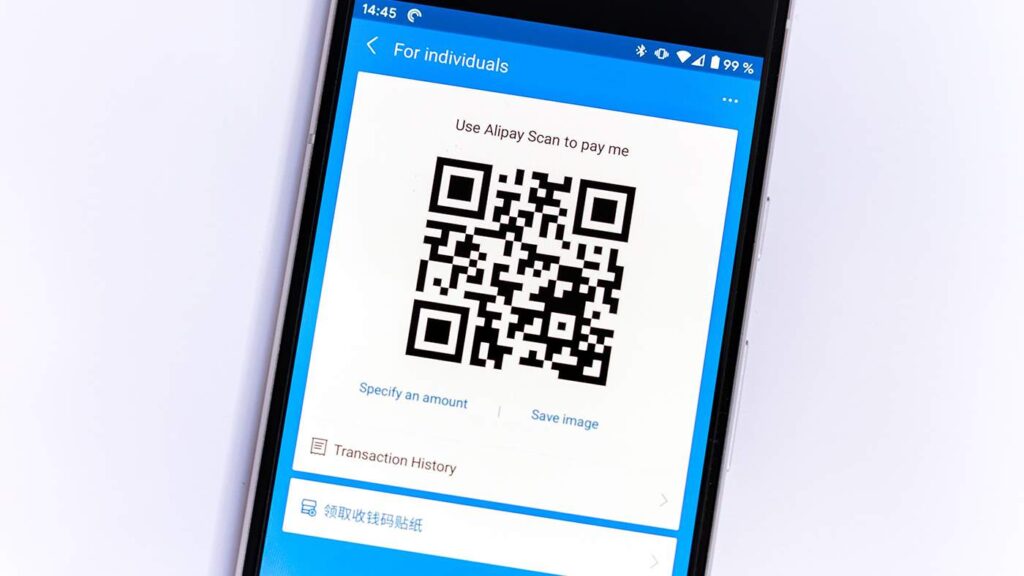

“PYMNTS/AmEx’s study noted that 30 percent of Americans made their first mobile wallet and contactless purchases during the pandemic’s early stages. And that rose to more than 50 percent of U.S. consumers who were using touchless payments by July. About one-third of shoppers now say that contactless payment options are their go-to method for making purchases… merchants looking to succeed in the coming environment need to provide things like contactless payments. Adopting touchless payment options and creatively enhancing QR codes’ functionality looks like a win-win for customers, employees and merchants alike.”

Read more about the report here.

Contactless isn’t a fad, it’s becoming the new normal for retail. It’s important to understand how you can provide your shoppers with the features and options they now want and expect. With Versatile Credit’s Snap Sign technology retailers can provide customers with a way to apply for financing directly on their mobile phone, throughout the store. Reach out to us today to learn more about how Versatile Credit can help you bring your comprehensive financing options directly to your customers!